At first glance, SCHUFA might seem like just another acronym in the vast world of German bureaucracy. However, its significance runs deep in the German financial landscape, and understanding it is paramount for anyone looking to build a life here. Why? Because SCHUFA isn’t merely about numbers on paper; it’s about trust, credibility, and opportunity.

Imagine wanting to rent that perfect apartment overlooking the Rhine or taking out a loan for your dream startup venture. Now imagine being turned down for reasons unknown to you. That’s where SCHUFA comes into play. It’s more than just a report—it’s your financial passport in Germany.

We’ll break down its essence, its role, and most importantly, guide you step by step on how to get a SCHUFA report and understand it.

KEY TAKEAWAYS

- SCHUFA is Germany’s primary credit reporting agency, vital for various financial decisions.

- Your SCHUFA score reflects your creditworthiness based on past financial behaviors.

- A strong SCHUFA score is essential for favorable terms in loans, rentals, and contracts.

- Both locals and foreigners, like expats and students, need SCHUFA for various activities in Germany.

- Obtaining a SCHUFA report is straightforward, usually through online platforms or banks.

- Interpretation of the SCHUFA report is crucial, with a score range from 0 to 100% indicating creditworthiness.

- Good financial habits, timely payments, and limited debt enhance your SCHUFA score.

What is SCHUFA? Unraveling the German Financial Enigma

SCHUFA might sound mysterious, especially if you’re hearing about it for the first time. However, its role in the German financial system is quite straightforward, and incredibly pivotal. Let’s unravel this financial enigma.

Definition and Core Purpose

SCHUFA stands for “Schutzgemeinschaft für all gemeine Kreditsicherung,” which translates to “Protection Association for General Credit Security.” Quite a mouthful, isn’t it? But, in simpler terms, SCHUFA is Germany’s main credit bureau. Its primary function is to collect and maintain data related to the credit histories of individuals residing in Germany.

How SCHUFA Operates

Every time you open a bank account, take out a loan, or sign up for a credit card in Germany, this action is recorded and sent to SCHUFA. The organization then compiles this information to create a credit profile for you, which will eventually result in a SCHUFA score. This score, expressed as a percentage, reflects your reliability as a borrower.

The Impact of the SCHUFA Score

Having a good SCHUFA score is akin to having a key to many doors in Germany. It determines whether you’re creditworthy. Landlords might consult your SCHUFA score before renting out an apartment to you. Similarly, banks and credit institutions reference it when deciding to approve loans or credit cards. A higher score means you have a history of being responsible with your financial obligations, making you an attractive prospect to lenders and landlords alike.

A Comprehensive Database

SCHUFA is not just about loans and credit cards. It covers a broad spectrum of your financial interactions. This includes information from telecommunication companies, ecommerce businesses, and even unpaid bills.

Why is SCHUFA Important? More Than Just a Number in Germany

Ah, the central question: why should one, especially someone new to Germany, be concerned about this SCHUFA? Isn’t it just another piece of the bureaucratic puzzle? Well, SCHUFA, in reality, is more akin to the cornerstone of the financial architecture in Germany. Let’s explore its multifaceted significance.

When it comes to housing in Germany, a good SCHUFA score is more than useful—it’s often vital. Landlords rely on it to gauge tenant reliability, while those eyeing property purchases find that favorable scores can lead to better mortgage rates.

This score also wields power in various financial decisions, from securing personal loans to setting credit card terms. Everyday services, such as mobile contracts and utilities, might consult your SCHUFA rating to ensure consistent payment.

Think of it as your financial footprint in Germany; a robust score not only grants easier access to services but strengthens continued trust. Plus, in life’s unexpected moments—be it further education or unexpected ventures—a solid SCHUFA can be your safety net.

Beyond lending insights, SCHUFA also plays a protective role, helping to monitor and prevent over-indebtedness.

How to Obtain Your SCHUFA Report: A Step by Step Guide

Embarking on the journey to access your SCHUFA report might feel like stepping into unfamiliar territory, especially if you’re new to Germany. But fret not! We’re here to guide you through this process with clarity, ensuring that you sail smoothly. Let’s take it step by step.

Option A: Online Portals

Using ‘meineSCHUFA‘. This is SCHUFA’s official online service. By registering on this portal, you can access your SCHUFA report and even monitor it regularly.

- Visit the ‘meineSCHUFA’ website (Click here).

- Register with your details.

- Choose the service you need (there are options for one-time access or continuous monitoring).

- Pay any applicable fees.

- Access your report.

Pros:

- Convinient

- Quick

Cons:

- There might be fees associated, especially if you opt for continuous monitoring.

Option B: Bank Brances

Several banks in Germany collaborate with SCHUFA to offer their customers access to their SCHUFA reports.

- Visit your bank’s local branch.

- Ask a representative about accessing your SCHUFA report.

- Provide necessary identification.

- The bank may print it for you on the spot or guide you on how to access it online via their portal.

Pros:

- Reliable

- Offers a chance for face-to-face clarification of doubts

Cons:

- Limited to banking hours

- Not all banks may offer this service

Option C: SCHUFA Kiosks or Bureaus

In various German cities, SCHUFA operates its own kiosks or information points.

- Locate your nearest SCHUFA bureau.

- Visit with proper identification.

- Request your report in person.

- A representative will assist you and provide a printed copy.

Pros:

- Direct interaction with SCHUFA representatives can help in understanding your report better

Cons:

- Limited to the bureau’s operating hours

- Might require some travel

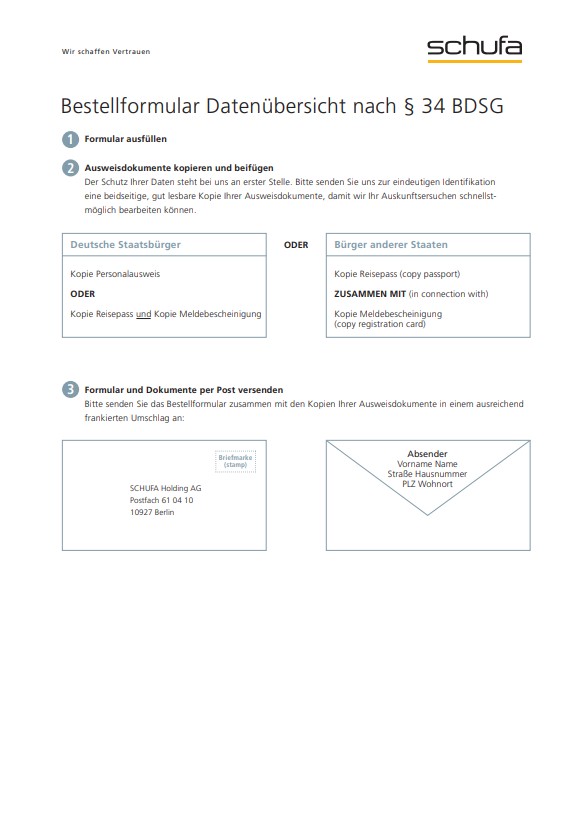

Option D: Postal Method

If you prefer the old-school, traditional, but reliable way or have limited internet access, this method is for you.

- Write a formal request for your SCHUFA report. Make sure to include your full name, date of birth, current address, and a copy of your passport or ID for verification.

- Mail it to the SCHUFA holding AG address (commonly provided on their official website).

- Wait for the report to be mailed back to your address.

Pros:

- Can be done from anywhere

- Doesn’t rely on online portals

Cons:

- Takes more time due to postal delays

- Requires you to ensure the correct details and documentation are sent

Costs Associated with SCHUFA

As you venture into obtaining your SCHUFA report, understanding the associated costs is paramount. Think of it as an investment in your financial transparency and credibility in Germany. Here’s a clear breakdown to guide you through the financial implications of accessing your SCHUFA data.

Free Annual Report

In Germany, it’s your legal entitlement to get a complimentary copy of your SCHUFA data report every year, a provision enshrined in law as “Datenübersicht nach § 34 Bundesdatenschutzgesetz.” Whether you choose to request this report through SCHUFA’s website or via mail, always emphasize that you’re seeking the § 34 BDSG report to steer clear of any charges.

You can find the formula here.

‘meineSCHUFA’ Online Services

If you’re inclined to peek at your SCHUFA score online beyond the annual freebie, be prepared to foot a bill. Last I checked, the price for this one-off online glimpse stood at about €29.95, though it’s wise to verify the current rate on SCHUFA’s site. For the meticulous among us who prefer an uninterrupted monitoring of their credit score, SCHUFA has subscription options. Depending on the granularity and update frequency you’re after, monthly charges could range between €3.95 to €7.95.

At Partner Banks or SCHUFA Bureaus

Venturing into a bank or a SCHUFA kiosk for your report can be a mixed bag. Some banks might graciously hand it over for free, especially to their patrons, while others might attach a fee. Likewise, a direct SCHUFA booth might ask for a service fee. When I last got wind of it, the cost for such a direct fetch was approximately €18.50, but it’s a good practice to account for regional variations and specific service tweaks in pricing.

Extra Services

For those seeking more than just numbers and craving a deeper dive into their financial standing, SCHUFA obliges with a more comprehensive package. Beyond the bare report, they delve into explanations and even proffer advice on boosting your score. The price tag for this enhanced service, naturally, corresponds to the depth of insights they offer.

Caution against Third-party Services

The digital realm is teeming with entities promising to procure your SCHUFA report. While a handful might be genuine, a sizable chunk could be out to make a quick buck, either through steep fees or shady practices. To keep both your finances and data safe, it’s best to lean on official avenues or reputed banks for your SCHUFA needs.

Who Needs SCHUFA?

Germany’s dynamic culture and booming economy lure a diverse group of individuals, each on their own unique path. If you’re contemplating the relevance of SCHUFA to your German experience, here’s a breakdown of its significance to different personas.

Expatriates (Expats)

Moving to Germany for professional pursuits means laying down new financial roots. As an expat, be it for a new job or launching a business, a strong SCHUFA score becomes your ally. It guides you in everything from securing a place to live to accessing top-tier financial products. And if Germany is set to be your long-term residence, nurturing a healthy SCHUFA score lays a solid financial groundwork for future endeavors.

International Students

The student experience often begins with securing accommodation, where a SCHUFA report acts as a testament to your financial trustworthiness. As you balance academics with potential part-time work, there will be encounters with local banking, possibly a credit card application or even exploring student loans. In these financial escapades, SCHUFA remains a steadfast companion, influencing decisions and opportunities.

Long-term Tourists

For those in Germany on extended stays, be it a prolonged vacation, a sabbatical, or other long-term ventures, interactions with the local economy are inevitable. Whether it’s a gym membership, securing a local phone number, or arranging short-term housing, a commendable SCHUFA score simplifies these tasks. Even without employment or academic pursuits here, your financial engagements during your stay will shape your SCHUFA narrative.

Freelancers and Entrepreneurs

Embarking on entrepreneurial journeys or freelancing in Germany comes with its set of financial interactions. Your SCHUFA score could influence facets ranging from obtaining business loans to leasing workspace. Moreover, in the business realm, where reputation is paramount, a respectable SCHUFA score can enhance your standing in professional communities.

Individuals with Family in Germany

If familial ties bring you to Germany, financial engagements often follow suit. Whether it’s purchasing family property, making investments, or assisting loved ones, SCHUFA’s shadow will often be present, influencing the ease and terms of these engagements.

Understanding Your SCHUFA Report: Deciphering Your Financial Story in Germany

Receiving your SCHUFA report is one thing, but understanding its intricacies is another. At first glance, the report might seem like a maze of numbers and terms. But with a bit of guidance, it can transform into a transparent reflection of your financial journey in Germany. Let’s dive in and decode it.

SCHUFA Score

Your SCHUFA score is a number between 0 and 100%. A higher score indicates lower credit risk, meaning you have a positive financial history and are less likely to default on payments.

| Score: | Risk |

|---|---|

| 95% – 100% | Very low risk |

| 90% – 95% | Low to manageable risk |

| 80% – 90% | Satisfactory to increased risk |

| 50% – 80% | Significant to high risk |

| 0% – 50% | Very high risk |

Personal Information

This section outlines your personal details like name, date of birth, and current address. It’s essential to ensure this data is accurate to avoid any misrepresentations.

Credit Accounts and Details

This section lists all your credit-related activities. It will showcase loans (whether they’re personal, home, or car loans), credit card accounts, and any overdraft facilities you might have.

Note the status: “Active” indicates an ongoing credit relationship, while “Closed” means the account has been settled.

Payment Anomalies

Any delays, defaults, or issues with your payments will be recorded here. It’s crucial to address any negative entries, as these can significantly affect your SCHUFA score.

Contractual Obligations

Here, you’ll find non-credit obligations like mobile phone contracts, internet subscriptions, and even gym memberships. Regularly meeting these obligations positively influences your SCHUFA score.

Inquiries

This section notes when and who has checked your SCHUFA score in the past 12 months. Regular checks by credit institutions might be a red flag for potential lenders. However, personal inquiries (when you check your score) do not affect your rating.

Tips and Guidance

Some SCHUFA reports, especially those with added analysis, will provide tips or insights to help you understand how to improve or maintain your score.

Legend or Glossary

Most SCHUFA reports come with a legend or glossary to help you understand the specific terms used. It’s a handy reference to clarify any doubts.

10 Tips to Maintain a Good SCHUFA Score

Your SCHUFA score is akin to a living entity, a reflection of your financial behavior and choices in Germany. But the good news is, much like a plant that thrives with care and attention, your SCHUFA score can flourish with thoughtful financial habits. Here are some nurturing tips to help you maintain a healthy and impressive SCHUFA score.

- Timely Payments: This is the golden rule. Always pay your bills—be it rent, credit card, loans, or even smaller commitments like gym memberships—on time. Delays or defaults can leave a negative mark on your SCHUFA report.

- Limit Credit Inquiries: Frequent credit applications can indicate financial distress. Even if you’re just shopping around for the best rates, lenders might view multiple inquiries as a sign of risk. It’s wise to space out credit applications and do thorough research before applying.

- Maintain Older Credit Accounts: Long-standing credit relationships, especially those in good standing, reflect stability. So, think twice before closing that old credit card account you’ve managed responsibly.

- Monitor Your Report: Check your SCHUFA report annually (remember, you’re entitled to one free report each year) to ensure all the information is accurate. Mistakes can happen, and it’s essential to address any inaccuracies promptly.

- Limit Outstanding Debt: While it’s okay to have loans and credit cards, it’s the balance that matters. Maxed-out credit cards or hefty loans might indicate that you’re living beyond your means. Aim to keep your debt levels manageable.

- Diversify Your Credit: A mix of different credit types—like a credit card, a personal loan, and a retail account—managed responsibly can boost your score. It shows lenders that you can handle various credit formats diligently.

- Avoid Negative Entries: Serious infringements like bankruptcy, tax liens, or legal judgments can severely harm your SCHUFA score. It’s essential to address financial issues head-on before they escalate to this level.

- Stay Informed: Financial norms and credit scoring systems can evolve. Stay updated with any changes in the credit system in Germany and adjust your financial habits accordingly.

- Be Cautious with Guarantees: If you vouch for someone’s loan or financial obligation (a practice more common among close friends and family), remember: if they default, it can negatively impact your SCHUFA score. Be sure of the risks before co-signing or giving guarantees.

- Establish a Financial Routine: Regularly review your finances. Set up automated payments for bills, check your bank statements for discrepancies, and make a habit of budgeting. A proactive approach to finances often reflects favorably on your SCHUFA score.

- Official SCHUFA Website: For detailed information, FAQs, and direct services, the official SCHUFA website (also available in English) is an invaluable resource.

- Federal Financial Supervisory Authority (BaFin): BaFin oversees banks, financial services institutions, and more. Their website provides regulatory information and guidelines to ensure transparency and fairness in Germany’s financial markets.

- Make it in Germany: A government initiative, Make it in Germany offers comprehensive guides on living, working, and, of course, managing finances in Germany for foreigners.

FAQs

How often does the SCHUFA score update?

Your SCHUFA score is recalculated regularly, typically once a month. However, significant changes like loan approval or closure can prompt a more immediate update.

Does checking my own SCHUFA score affect it?

No, personal inquiries (when you check your own score) do not impact your SCHUFA score. It’s labeled as a ‘neutral’ check and won’t be visible to third parties.

How long do negative entries stay on my SCHUFA report?

Most negative entries remain on your report for a period of three to five years. However, some severe entries, like bankruptcy, can stay longer.

I just moved to Germany; will I have a SCHUFA score immediately?

Newcomers might not have a SCHUFA score immediately. A score is generated once you engage in financial activities, like opening a bank account or signing a mobile contract.

Is SCHUFA the only credit agency in Germany?

While SCHUFA is the most prominent, there are other credit agencies in Germany. However, SCHUFA is the most widely recognized and utilized.

Can I improve a bad SCHUFA score?

Absolutely! By adopting good financial habits, addressing negative entries, and demonstrating responsible credit management, you can positively influence and improve your SCHUFA score over time.

Are all loans and credit activities reported to SCHUFA?

Most, but not all. While a vast majority of financial institutions report to SCHUFA, some minor or specialized lenders might not. It’s always a good idea to inquire with the lender directly.

I paid off a debt, but my SCHUFA score didn’t improve immediately. Why?

While paying off a debt is a positive step, the SCHUFA score considers numerous factors. It might take some time for positive actions to reflect significantly on your score. Consistency in good financial behavior is key.

Do other countries recognize or use the SCHUFA score?

The SCHUFA score is specific to Germany. While it won’t be directly used in other countries, financial institutions abroad might ask for it (or a similar credit report) if you’re involved in international financial transactions.

Can I challenge or dispute an incorrect entry on my SCHUFA report?

Yes, if you believe there’s an error on your report, it’s essential to raise it with SCHUFA or the reporting institution. They have processes in place to investigate and rectify genuine discrepancies.